Hydrogen Supply Chains: A Detailed Look at How They Work

The global discourse around energy often seems to revolve around one element in particular: carbon. Carbon is the building block of crucial fuel sources like petroleum, coal, and natural gas. Indeed, it’s the carbon dioxide (CO2) created from burning these carbon compounds that is a major source of our greenhouse gas emissions and, therefore, a major component of the ongoing climate crisis.

Those familiar with organic chemistry are, of course, aware that the carbon compounds mentioned above that make up well-known fossil fuels are more precisely known as hydrocarbons, as they are made up not just of carbon atoms, but by hydrogen atoms as well. When these hydrocarbons react with oxygen, they give off carbon dioxide – a potent greenhouse gas – water, and a large amount of heat energy.

But hydrogen has tremendous potential as an energy source in its own right, independent of hydrocarbons. Hydrogen is the lightest element in the known universe, with an atomic weight of just one. Despite its small size, hydrogen packs quite a punch in terms of its energy content. And by removing carbon from the chemical equation,

In this article, we’ll discuss the current state of the use of pure hydrogen as an energy source, focusing primarily on the current and potential future supply chain for this tiny element.

What is the hydrogen economy?

An economy in which hydrogen is the primary energy source is called a “hydrogen economy.” This contrasts with what our current hydrocarbon economy, in which fossil fuels like natural gas, oil and coal are the primary energy sources.

Proponents of a hydrogen economy argue that it would be far cleaner and more sustainable than the current reliance on hydrocarbons. However, there is currently far too little hydrogen economy infrastructure in place to produce, store, transport and utilize the amount of hydrogen that would be needed to run a substantial portion of the global economy.

The total global value of annual hydrogen generation in 2021 was estimated at just under $130 billion USD and is expected to grow at a compound annual growth rate (CAGR) of about 6.4 percent through the end of the current decade. By contrast, the global oil and gas market was worth roughly $4.7 trillion USD in 2020 and expected to grow to $5.9 trillion by 2021, a CAGR of over 25%.

This doesn’t mean that we will never reach a hydrogen economy, however. The global economy is capable of massive reorganization given proper macroeconomic incentives. Consider, for example, the rapid adoption of the hydrocarbon economy from an economy based primarily on water, wind and animal power just a couple of hundred years ago. Even 100 years ago, the infrastructure to support the widespread use of automobiles was in its infancy, and today’s it’s almost impossible to imagine a world without cars.

As concerns over greenhouse gas emissions and energy independence grow, expect demand for alternative energy sources to push the nascent hydrogen economy towards an inflexion point in the coming decades.

How is hydrogen produced?

First, let’s consider how pure hydrogen is created here on Earth. “Wait a minute,” you might be thinking. “I thought hydrogen was incredibly abundant and naturally occurring?” That’s true, especially when we’re talking about the universe as a whole, in which hydrogen in plasma phase makes up the majority of the mass of stars like our sun.

On Earth, though, hydrogen is almost always combined with other elements to make some common molecules you’re likely very familiar with—like water and the hydrocarbons we’ve been comparing pure hydrogen to. In order to use hydrogen as an energy source, hydrogen molecules have to be stripped away from the molecules they’re attached to.

- In the case of water, this means separating hydrogen from oxygen using electrolysis.

- In the case of natural gas, high-temperature steam is combined with natural gas to create hydrogen, carbon monoxide and some carbon dioxide. The carbon dioxide can be further reacted with water to produce even more hydrogen. This process of “natural gas reforming” or “gasification” is currently the most inexpensive and most widely used method for producing elemental hydrogen in the United States.

Did you notice the fundamental catch with hydrogen baked into that creation process?

Producing elemental hydrogen takes energy.

- If you create it from water, you have to use electrical energy.

- If you create it from natural gas, you have to use high-temperature steam, which takes energy to create and heat.

In fact, hydrogen as used on Earth is more properly thought of as an energy carrier as opposed to a true fuel. Energy used to separate hydrogen from water or hydrocarbons can later be released by combusting hydrogen with oxygen. As noted above, this creates water as a bi-product, which gets us back to one of the original sources of hydrogen used in the production stage.

Unfortunately, while hydrogen technology continues to improve, there is always energy lost as part of this process, meaning we can’t currently get the amount of energy out of combusting a particular amount of hydrogen that goes into “creating” the pure hydrogen in the first place.

Hydrogen production cost

Using current technology, it costs roughly $2.50 to $6.80 to create one kilogram of pure hydrogen; however, new technologies, new methods of production and growing economies of scale are expected to significantly reduce that cost over the next 10 – 15 years.

A significant contributor to the cost of producing hydrogen is the cost of electricity used to strip hydrogen atoms away from water molecules and the energy (electric or otherwise) to create the high-temperature steam needed to strip hydrogen from natural gas. As renewable energy technologies improve, these costs should go down. At the same time, greater use of renewables will support the push towards a green hydrogen economy.

Transportation and storage are also major factors in the overall costs of hydrogen, even though they aren’t strictly part of the production process. Hydrogen is a small molecule that exists as a gas at normal temperatures and pressures, meaning it can be challenging to store and transport large masses of hydrogen, especially for long distances.

A look at 3 different hydrogen supply chains

As if the concept of a hydrogen supply chain to go along with our discussion of a hydrogen economy wasn’t complex enough, we’re actually going to be talking about three different hydrogen supply chains.

In general, supply chains include everything from production to storage and transportation and finally to usage.

- A global hydrogen supply chain, therefore, considers how these four buckets of activities take place on a global scale.

- The green hydrogen supply chain seeks to establish a carbon-free, fully renewable source of hydrogen.

- Finally, the hydrogen fuel cell supply chain focuses specifically on the mechanism for converting hydrogen to useful energy – the fuel cell.

Just as hydrogen itself has a supply chain to move it from production to usage, so too do the manmade fuel cells essential for that process.

Global hydrogen supply chain

While hydrogen is all around us, major corporations and governments are working to establish global supply chains. Why not save on transportation costs by producing, storing, and consuming hydrogen locally?

It all boils down to infrastructure and comparative advantages.

As we’ve already discussed, hydrogen is not readily available as a pure element on Earth in meaningful quantities. Instead, it must be stripped away from hydrocarbons and water. This requires specialized equipment and processes that are far more efficient when scaled up to create large volumes of hydrogen, as opposed to many smaller facilities creating hydrogen only for local or regional use. Once the hydrogen is produced, additional technology and infrastructure are needed to transport that hydrogen, such as the Composite Overwrapped Pressure Vessels (COPVs) sold by Advanced Structural Technologies (AST). Finally, demand for hydrogen is not uniform around the globe.

Some countries have invested more in hydrogen fuel cell technology and use than others and therefore have a greater demand for hydrogen. Because macroeconomic conditions make some locales relatively more cost efficient to produce hydrogen than others, there may be a mismatch between the most efficient place to make the hydrogen and the place that has the greatest demand for hydrogen – hence, a global supply chain.

Green hydrogen supply chain

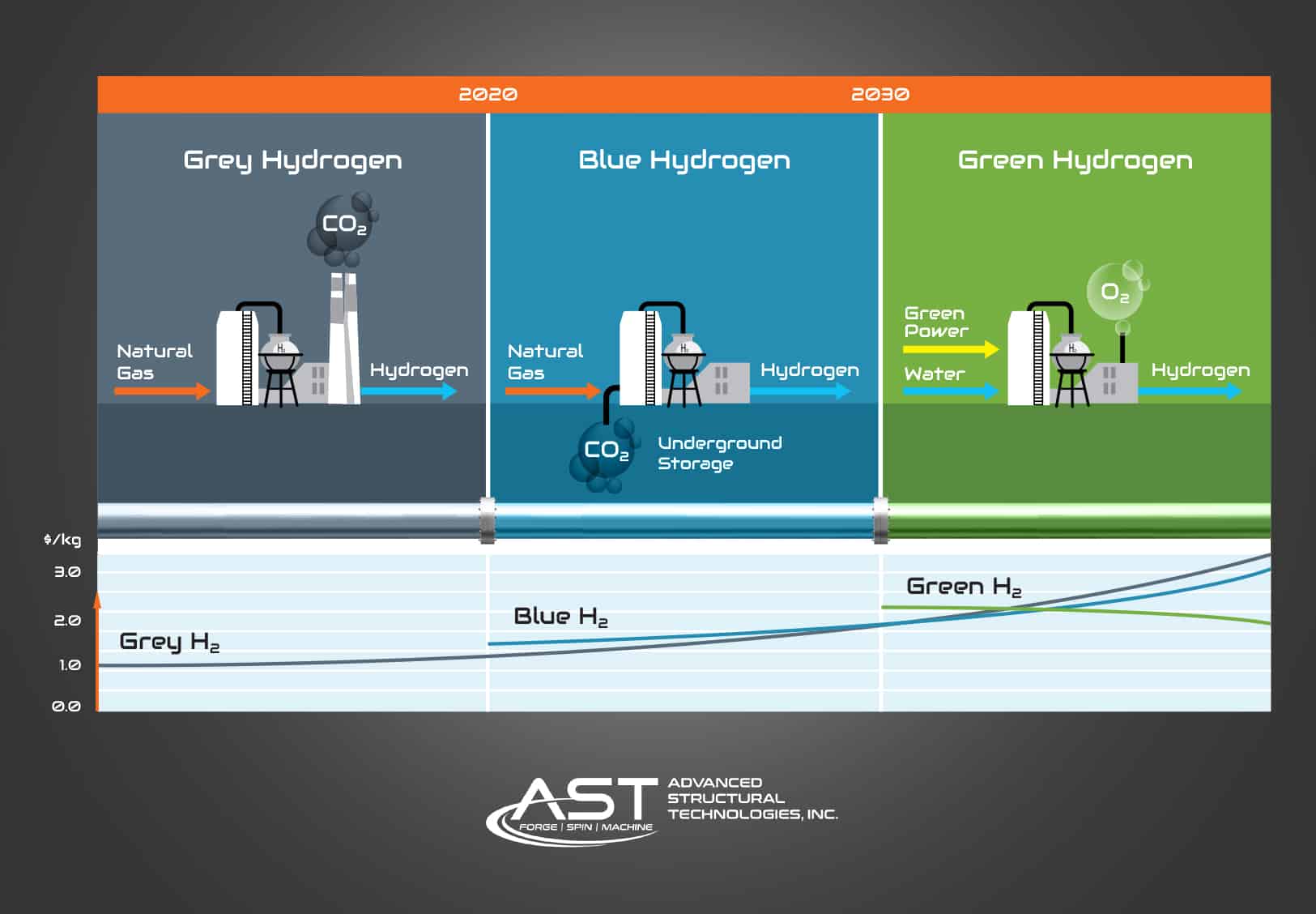

We mentioned previously that production of hydrogen from natural gas is currently the most widely used and most efficient method. Because this production method creates the greenhouse gas CO2 as a bi-product, it’s not exactly a green energy source, and it’s commonly referred to as “grey hydrogen.” If the CO2 created by grey hydrogen is prevented from entering the environment, such as through carbon capture technologies, it’s referred to as “blue hydrogen.”

While blue hydrogen is more environmentally friendly than grey hydrogen, the real ambition for a clean hydrogen economy is focused on hydrogen produced without any fossil fuels at all—by adding electricity to water to separate the hydrogen from the oxygen atoms. This is known as “green hydrogen” and is currently much less efficient than grey or blue hydrogen.

Given the importance of environmental concerns in global energy production and consumption, it’s possible that advances in hydrogen production technology will someday make green hydrogen economically competitive with grey hydrogen, not to mention fossil fuels. This is the primary goal of the green hydrogen supply chain; however, the hydrogen associations and advocates agree that the 7+ colors are not a tangible way to measure when it comes to create a net-zero carbon roadmap. Colors cannot be measured, but having calculated the carbon footprint, we can develop property energy and carbon strategy with short and long-term targets.

Hydrogen fuel cell supply chain

Getting hydrogen from water and/or hydrocarbons and transporting it to end users is only one part of the broader hydrogen economy supply chain. Those end users need a means by which to convert all that hydrogen energy into work.

This is where the hydrogen fuel cell comes into play. A fuel cell can use a variety of fuels, including hydrogen, to convert that fuel to electricity and heat. In the case of hydrogen, water is also produced as a bi-product.

Fuel cells are an essential part of the hydrogen economy, and a dependable hydrogen fuel cell supply chain is therefore critical. As hydrogen use increases, the U.S. Department of Energy estimates that the domestic hydrogen market will require over 50 GW of total domestic fuel cell capacity and as much as 3 GM/year annual manufacturing rate to supply heavy-duty vehicles, medium-duty vehicles and electricity generation.

According to the DOE, the current supply chains for hydrogen fuel cells includes five key components:

- Extracting raw materials.

- Transforming raw materials into processed materials.

- Manufacturing subcomponents.

- Manufacturing components.

- Recovering materials at end of life.

Key raw materials include metals like platinum, used as a key catalyst in the hydrogen combustion reaction. The United States is actually on pretty solid ground with respect to this supply chain in the context of the current hydrogen market. Domestic sources of raw materials plus existing imports provide sufficient inputs to the manufacturing process, and domestic manufacturing has both the capacity and technical sophistication to meet the nation’s present fuel cell demand. However, as hydrogen use increases, as is expected in coming years, it is likely that the U.S. will need to take a more global view of fuel cell supply chains. This will mean not only increasing imports of certain raw materials but also potentially turning to global partners as part of the manufacturing process.

Hydrogen supply chain companies

Many investors have recognized the potential of hydrogen energy in the future global economy, and several major players have emerged to help lead the charge in developing and improving the technologies and methods that will make the hydrogen economy possible.

- AST has over 150,000 sq. ft. of manufacturing space and has been in business over twenty years; recently leveraged its experience to tackle alternative energy challenges, including the hydrogen supply chain.

- Chiyoda Corporation made headlines in 2020 when it and several partners including Mitsubishi, Mitsui and NYK Line completed the first global hydrogen supply chain demonstration by transporting and storing over 100 tons of hydrogen for over ten months.

- Toyota and Hyundai are two leaders in the development of hydrogen fuel cell cars that represent the end of the supply chain in many ways for both hydrogen and hydrogen fuel cells.

Other companies on the leading edge of the hydrogen energy economy include: Air Products, Plug Power, Bloom Energy, Ballard Power Systems, FuelCell Energy, Iwatani, Shell, Chevron, Siemens.

Evolution and future of hydrogen supply chain

What does the future hold for the hydrogen supply chain, and how far away are we from a genuine hydrogen economy?

The short answer is that we aren’t there yet, but that this greener future could be just around the corner. A few key prerequisites need to be firmed up before this industry can really take off, however.

For one, greater availability of renewable energy can really complement the green potential of hydrogen. Remember that hydrogen here on Earth is better thought of as an energy carrier than a fuel, and it takes energy to create pure hydrogen. Using renewables for this purpose instead of hydrocarbons is key to scaling hydrogen production cleanly.

Additionally, the world has a long way to go in terms of developing the level of infrastructure needed to support a hydrogen economy. This development has been a slow and steady journey to date, but as the demand for alternative energy sources increases and the technology around hydrogen storage and transportation continues to drive down costs, don’t be surprised to see a boom in the hydrogen industry coming seemingly out of nowhere. This may include adapting existing technologies for use in the hydrogen industry, such as using compressed natural gas (CNG) storage technologies and processes in the hydrogen world.

Advanced Structural Technologies (AST) is a leader in hydrogen storage and transportation technologies that is helping lead the industry in economical and efficient solutions to many hydrogen supply chain challenges. For example, our self-contained storage pods allow for secure, efficient, and compartmentalized storage of large volumes of hydrogen for easy transport. Contact us today to learn more about our advanced hydrogen supply chain solutions.